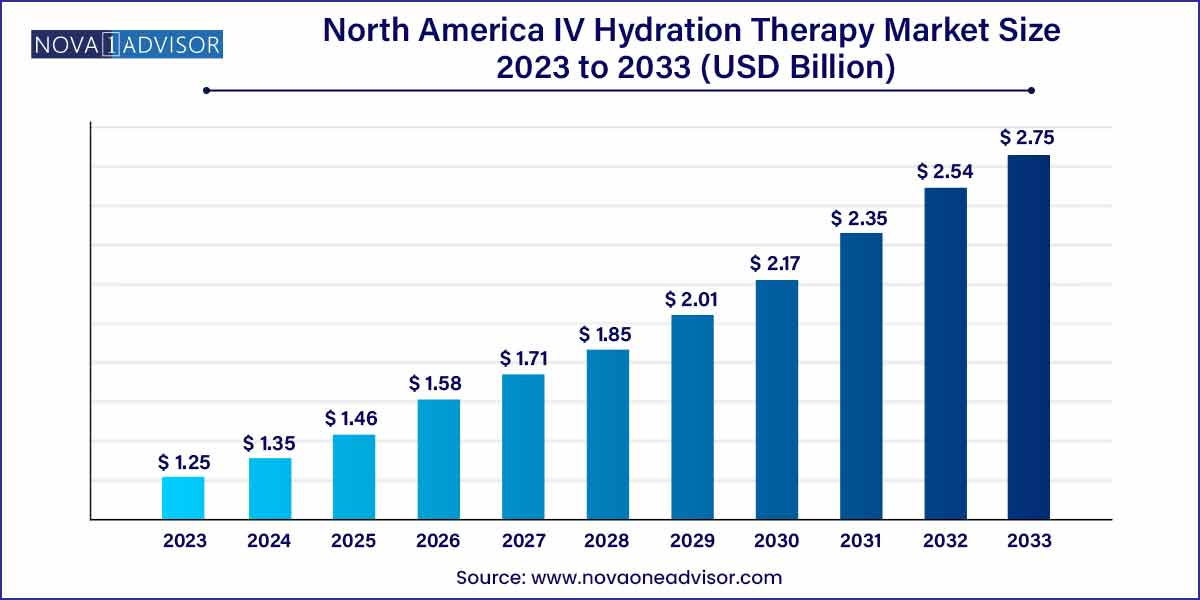

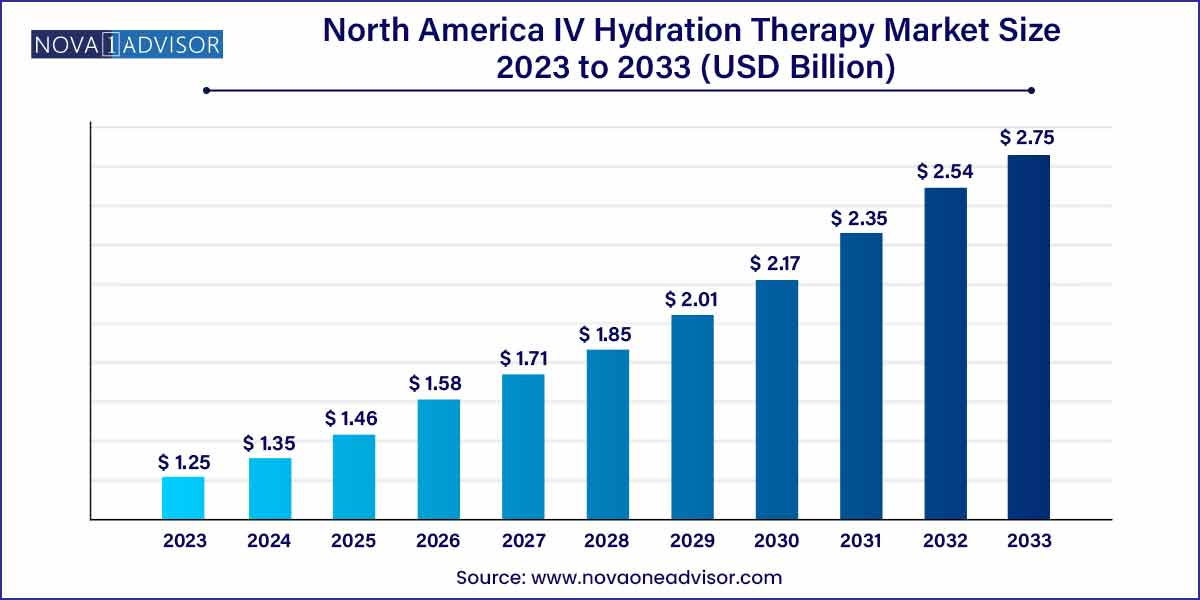

The North America IV Hydration Therapy market size was estimated at USD 1.25 billion in 2023 and is projected to hit around USD 2.75 billion by 2033, growing at a CAGR of 8.2% during the forecast period from 2024 to 2033.

Key Takeaways:

- The U.S. dominated the overall market with a revenue share of 86.18% in 2023.

- Canada is expected to grow at a significant rate during the forecast period.

- Based on age, the 18-60 segment accounted for the largest revenue share of 53.12% in 2023.

- The 60+ segment is anticipated to witness significant market growth over the forecast period,

- Based on type, the energy boosters segment accounted for the largest revenue share of 28.9% in 2023

- Immune boosters segment anticipated to witness the significant market growth over the forecast period.

- Based on gender, the woman segment accounted for the largest revenue share of 52.17% in 2023

- Men segment is anticipated to witness a significant market growth over the forecast period

- Based on end-use, the hospitals & clinics segment accounted for the largest revenue share of 41.15% in 2023.

- The home healthcare segment is estimated to register the fastest CAGR over the forecast period.

Market Overview

The North America Intravenous (IV) Hydration Therapy Market is emerging as a promising frontier in both preventive healthcare and wellness services. Initially rooted in hospital and emergency care, IV hydration has evolved into a versatile therapy embraced not only by medical institutions but also wellness centers, spas, and even mobile services. This transformation is propelled by growing consumer interest in wellness, rapid recovery, beauty treatments, and personalized medicine.

IV hydration therapy involves delivering fluids, electrolytes, vitamins, and medications directly into the bloodstream. This ensures immediate absorption, making it superior to oral supplementation in cases where rapid rehydration or bioavailability is essential. In North America, the therapy has found wide applications ranging from hangover relief, immune system boosts, skin rejuvenation, athletic recovery, migraine relief, and chronic condition management.

The rise in disposable income, increased health consciousness, urban stress levels, and the influence of social media wellness influencers have fueled public demand for fast, accessible, and effective wellness solutions. The U.S. and Canada host a growing number of IV bars, med spas, concierge healthcare services, and even at-home IV drip providers that serve high-performance athletes, celebrities, business executives, and regular consumers alike.

Major Trends in the Market

-

Proliferation of Mobile IV Services: On-demand at-home IV therapy services are growing in popularity, especially in urban hubs.

-

Wellness and Beauty Infusion Packages: Clinics and spas are bundling hydration with anti-aging, weight loss, and skin care treatments.

-

Celebrity and Influencer Marketing: Social media endorsements from celebrities and wellness influencers are boosting public interest and social acceptance.

-

Preventive Healthcare Integration: Increasing use of IV drips to boost immunity, energy, and overall wellness, particularly post-COVID.

-

Customized Drip Formulations: Personalization using DNA testing, nutrient panels, and medical screening for precision infusions.

-

Digital Booking and App-Based Services: Tech-enabled platforms are streamlining scheduling, subscription models, and loyalty programs.

-

Cross-Industry Collaboration: Partnerships between healthcare providers, wellness companies, and hospitality (e.g., luxury hotels offering in-room drips).

North America IV Hydration Therapy Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 1.35 Billion |

| Market Size by 2033 |

USD 2.75 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 8.2% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Type,age, gender, end-use, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Drip Hydration; DriPros IV Hydration Wellness; wHydrate; Renew Ketamine & Wellness Center; R2 Medical Clinic; AliveDrip; Hydrate IV; Hydration Room |

Key Market Driver: Rising Health Awareness and Preference for Preventive Wellness

A major driver for the North American IV hydration therapy market is the growing awareness and prioritization of preventive wellness and immune health. The COVID-19 pandemic served as a catalyst in redefining how people view personal health. Consumers across the U.S. and Canada have increasingly adopted a "wellness-first" mindset, placing a stronger emphasis on nutrient optimization, immune resilience, and proactive disease prevention.

IV hydration therapy fits squarely into this movement, offering an efficient, fast-acting solution for nutrient delivery that claims to help with fatigue, inflammation, and mental performance. Therapies containing Vitamin C, B-complex, zinc, glutathione, magnesium, and NAD+ have gained traction among wellness enthusiasts and patients managing chronic fatigue, anxiety, or post-illness recovery.

The ability of IV drips to produce immediate, noticeable effects—whether it be higher energy, improved skin glow, or faster recovery continues to draw in repeat consumers and word-of-mouth referrals.

Key Market Restraint: Regulatory Ambiguity and Clinical Efficacy Concerns

A notable restraint in the market is the lack of consistent regulation and medical oversight in non-hospital IV hydration services. While hospitals and clinics follow established protocols, many wellness and mobile providers operate in a regulatory gray zone, where medical supervision and product quality assurance may vary widely.

The FDA does not officially endorse IV hydration for wellness use beyond medical indications, and critics often cite a lack of robust clinical evidence supporting its long-term efficacy in healthy individuals. There are concerns over overuse, potential allergic reactions, vein damage, or infection when administered without proper training.

These regulatory and credibility challenges limit the ability of smaller providers to scale, discourage some consumers from trying the therapy, and create a barrier for insurance inclusion or employer wellness partnerships.

Key Market Opportunity: Integration with Concierge Medicine and Corporate Wellness

The strongest opportunity lies in the integration of IV hydration therapy with concierge healthcare models and corporate wellness programs. As businesses invest more in employee well-being and individuals seek exclusive, personalized medical experiences, IV hydration fits naturally into this paradigm.

Startups and established providers are now offering IV memberships, in-office drip lounges, and wellness concierge plans that include regular infusions, testing, and lifestyle tracking. In high-pressure sectors such as tech, finance, and hospitality, IV hydration is being positioned as a productivity and performance enhancer.

Hotels, gyms, yoga retreats, and coworking spaces are exploring partnerships with IV brands to offer wellness amenities, helping providers enter mainstream health infrastructure while reinforcing their luxury appeal.

Segments Insights

By Type

Immune boosters dominate the North American IV hydration market, particularly in a post-pandemic world where immune resilience is a primary consumer concern. These drips typically include high doses of Vitamin C, zinc, glutathione, and B12, aiming to prevent illness or assist in faster recovery. Clinics across the U.S. report spikes in demand for immunity formulas during flu season or following COVID exposure, reinforcing the seasonal strength of this segment.

Skin care infusions are the fastest-growing, appealing primarily to women seeking anti-aging, brightening, and detoxifying benefits. These drips often include glutathione, biotin, and Vitamin C, ingredients marketed for improving complexion, reducing pigmentation, and enhancing collagen synthesis. The beauty-conscious population in major urban areas like Los Angeles, Miami, and New York are propelling this segment’s expansion.

By Age

The 18-60 age group dominates, accounting for the largest consumer base for IV hydration therapy. This demographic includes young professionals, fitness enthusiasts, and millennials who are health-conscious, digitally connected, and willing to spend on self-care trends. Many within this group use IV therapy for energy, mental clarity, stress recovery, and beauty enhancements.

The 60+ segment is growing fastest, particularly in the context of hydration for chronic illness management, post-hospital recovery, and anti-fatigue therapy. Seniors, especially those in retirement communities or receiving home health services, are increasingly prescribed IV hydration as part of their health routine. This segment benefits from the growing availability of home-based IV therapy through visiting nurse services and private concierge healthcare.

By Gender

Women dominate the consumer base, particularly in the wellness and beauty-oriented subsegments of the IV hydration market. Women in North America are more likely to explore preventive health services, invest in skin treatments, and follow beauty influencers who promote IV drips for detox, glow, or weight loss benefits.

Men are a growing market, especially in sports recovery and biohacking categories. Professional athletes and executives are driving interest in performance-oriented drips containing NAD+, amino acids, and electrolytes. Marketing targeting male audiences has evolved to highlight mental stamina, productivity, and physical endurance, attracting this emerging consumer base.

By End-use

Hospitals and clinics dominate due to their use of IV hydration for medical conditions such as dehydration, nutrient deficiency, chemotherapy support, and post-operative recovery. These facilities operate under strict clinical standards and are more likely to be reimbursed by insurance, making them the most trusted and regulated channel.

Wellness centers and spas are the fastest-growing segment, offering IV therapy as part of luxury packages for rejuvenation, detox, and energy. These establishments capitalize on the experiential nature of wellness, with comfortable IV lounges, herbal teas, relaxing ambiance, and spa add-ons. Urban centers and vacation hotspots are major hubs for such services.

Country-Level Analysis

United States

The U.S. is the dominant country in the North American IV hydration therapy market, with the largest number of clinics, mobile units, and IV bars. States like California, Florida, New York, and Texas lead the charge, housing brands such as IV Drip Bar, Hydration Room, and Drip Hydration. The demand spans from urban health enthusiasts to high-net-worth individuals seeking concierge services.

Innovation in the U.S. includes integration of apps for on-demand nurse dispatch, telemedicine-based approvals, and subscription-based wellness plans. Insurance typically does not cover cosmetic hydration services, but the popularity continues to grow among out-of-pocket payers.

Canada

Canada is rapidly adopting IV hydration, particularly in Toronto, Vancouver, and Montreal, where wellness culture mirrors U.S. trends. Canadian IV lounges often position hydration as part of integrative care, emphasizing naturopathy, stress relief, and anti-aging. Regulatory oversight is somewhat stricter, requiring medical supervision for many services.

Public health entities in Canada are also exploring IV therapy for chronic care and senior populations, offering long-term potential for integration into provincial health services. Growth is expected through partnerships with spas, boutique hotels, and fitness centers.

Recent Developments

-

April 2025 – Hydration Room, a California-based IV therapy chain, launched a new “Glow & Go” drip focused on collagen and biotin, expanding to five new locations.

-

March 2025 – REVIV announced a partnership with several hotel chains in Miami and Las Vegas to provide in-room IV wellness services to guests.

-

February 2025 – IV Doc introduced an AI-based chatbot to recommend drip types based on symptoms and user history through its app.

-

January 2025 – NAD+ Therapy USA rolled out IV-based anti-aging treatments at luxury wellness resorts in Arizona and California, targeting baby boomers.

-

December 2024 – Drip Hydration Canada received approval to offer IV services in partnership with retirement homes in Ontario, emphasizing immune support for seniors.

Key North America IV Hydration Therapy Companies:

- Drip Hydration

- DriPros IV Hydration Wellness

- wHydrate

- Renew Ketamine & Wellness Center

- R2 Medical Clinic

- AliveDrip

- Hydrate IV

- Hydration Room

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America IV Hydration Therapy market.

By Type

- Immune Boosters

- Energy Boosters

- Skin Care

- Migraine

- Others

By Age

By Gender

By End-use

- Hospitals & Clinics

- Wellness Centers & Spa

- Home Healthcare

- Others

By Regional

- North America

- U.S.

- Canada